Quick Summary

Choosing the right cyber insurance policy helps protect your business from data breaches, ransomware, and other digital threats. Understand your risks, compare coverage options, check inclusions and exclusions.

Choosing the right cyber insurance policy helps protect your business from data breaches, ransomware, and other digital threats. Understand your risks, compare coverage options, check inclusions and exclusions.

Everyone, from large enterprises to small businesses and even individuals, is vulnerable to cyberattacks, data breaches, and other forms of online threats. A robust cyber insurance policy can help mitigate the financial losses associated with such risks. However, with several insurance providers offering varied plans, choosing the right cyber insurance policy in India can take time and effort.

According to a Deloitte report, India's cyber insurance market is currently worth around $50-60 million and is expected to skyrocket, with a compound annual growth rate (CAGR) of 27-30% over the next 3-5 years. On a global scale, the cost of cybercrime is projected to jump from $9.22 trillion in 2024 to a massive $13.82 trillion by 2028, as per Statista. This rapid growth highlights just how critical cyber insurance is becoming in today's digital world.

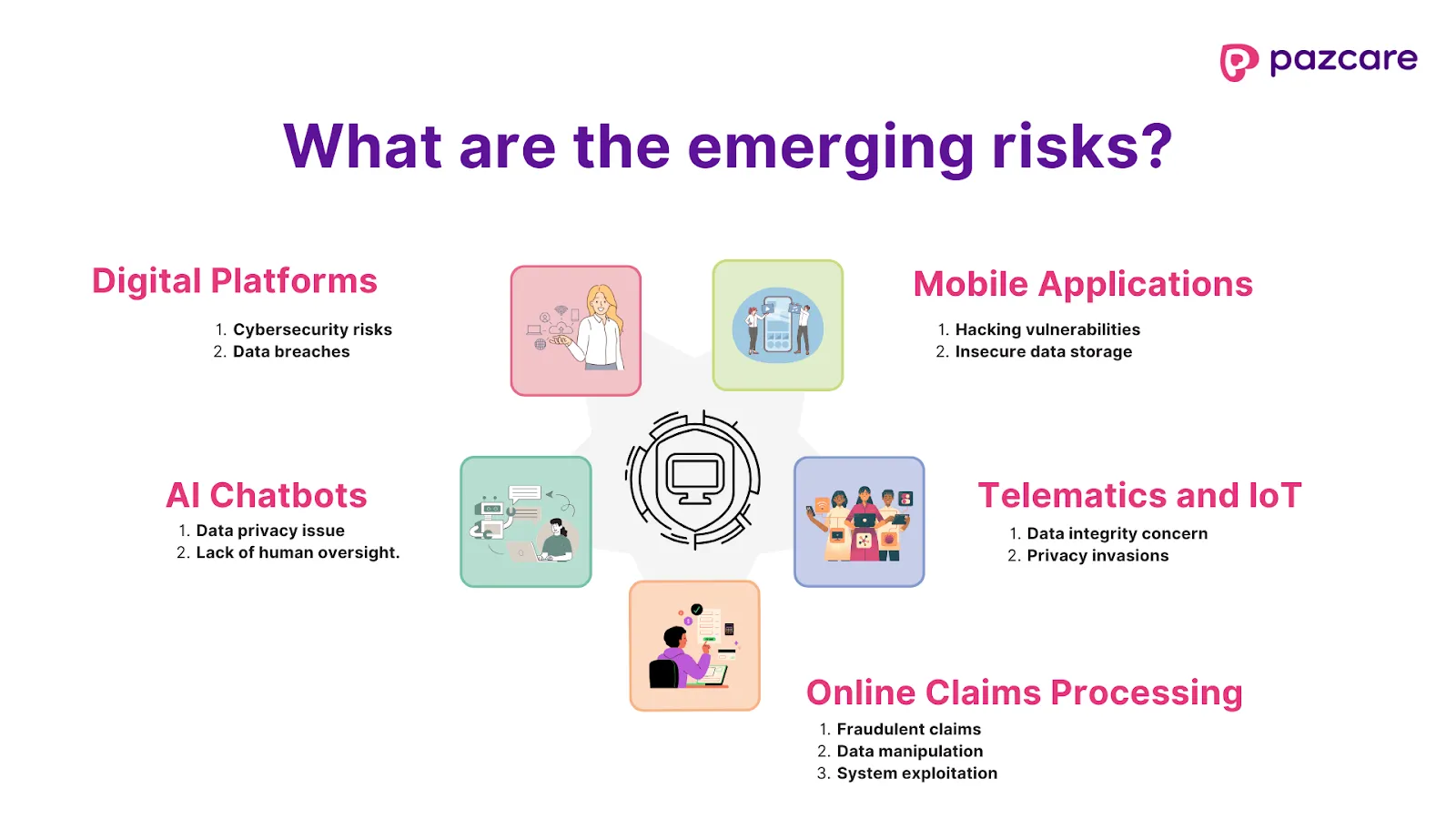

However, with each new tech breakthrough comes a fresh wave of challenges. As the industry evolves, so do the risks, making it harder for insurance companies and regulators to keep up with the ever-growing threat of cyberattacks. While technology is driving the industry forward, the risks that come with it can’t be ignored.

Let’s break it down and make the process as straightforward and data-backed as possible.

Before diving into the insurance hunt, you need to know what is a cyber risk profile. A cyber risk profile is like your digital fingerprint. It's a snapshot of how vulnerable you or your business are to online threats. It takes into account factors like the type of data you handle, the software and systems you use, and how much of your operations are online. Think of it as your personalized “risk score” that helps you understand where cyberattacks might hit and how severe the impact could be.

Before you buy a policy, evaluate:

For individuals, the risks range from online banking fraud to identity theft. So, whether you’re a business or an individual, assessing your digital footprint is the first crucial step.

Cyber insurance isn’t a one-size-fits-all product. The scope of coverage varies significantly from one policy to another. But here’s what you should ensure your policy covers:

Not all policies are created equal. Compare:

Every policy has exclusions, and ignoring these could leave you vulnerable. Before signing anything, go over these exclusions carefully. A study says that 24% to 27% of cyber insurance claims in 2023-2024 were either partially paid or denied due to exclusions in the policy. Common reasons for claim rejections include:

Another crucial factor is how much protection you’re buying. The coverage limit is the maximum amount the insurer will pay for a claim. For small businesses, a lower coverage limit may suffice, but larger companies handling vast amounts of sensitive data might need something more robust. Don’t forget to check if the policy has sub-limits—specific caps for areas like legal costs or data recovery. This is especially important if you operate in sectors like healthcare or finance, where data breaches can lead to costly lawsuits and regulatory fines.

A deductible is the amount you’ll have to pay out-of-pocket before the insurance kicks in. It’s tempting to go for a higher deductible to lower your premium, but tread carefully. Ask yourself: how much can your business (or personal finances) absorb before you expect help from the insurer? Lower deductibles mean less financial strain during an incident but higher premiums, while higher deductibles could make the policy more affordable but leave you vulnerable when it matters most.

For example, if a ransomware attack disrupts your operations for a week, and your deductible is too high, you could end up paying out-of-pocket for significant downtime and data restoration expenses before your insurance steps in.

No matter how great a policy looks on paper, it’s only as good as the company behind it. Claim settlement ratio, the percentage of claims settled versus the total claims filed is a critical indicator of an insurer’s reliability. A higher ratio means the company is more likely to approve claims. Check online reviews and customer feedback to see how quickly they process claims and if their customer service is up to par.

Choose insurers who specialize in or have strong experience with cyber risk.

They should offer:

Many insurers offer add-ons that provide specialized coverage for specific risks. Some common and useful add-ons include:

It’s tempting to focus solely on the premium when selecting a policy. However, it’s important to weigh the cost against the coverage you’re getting. A lower premium might seem attractive, but if the policy leaves you underinsured, you could end up paying much more when disaster strikes.

Finally, don’t hesitate to consult an expert. Cyber insurance policies can be complex, and navigating the fine print is easier with a professional who understands the nuances of the industry. They can guide you to the best policies for your specific needs and ensure you don’t miss any critical areas of coverage.

Talk to a Pazcare expert today to find the right cyber insurance policy for your organization.

Insufficient documentation: Many claims fail due to lack of proper documentation. Insurers require detailed proof of the incident, steps taken, and associated costs. Without timely, thorough records, your claim is at risk. However, the Insurance Regulatory and Development Authority of India (IRDAI) has come up with a new circular in June 2024. According to the circular, no claim shall be denied on the grounds of insufficient documentation. It states that necessary documents must be requested during the underwriting process of the proposal. Customers may only be required to submit documents that are essential for the settlement of their claims, particularly if cashless options are not available.

Lax cybersecurity practices: If your organization doesn’t follow basic cybersecurity measures, insurers may deny your claim, citing negligence. Ensure you meet security standards by implementing robust controls and keeping your systems up to date.

Undisclosed vulnerabilities: Claims can be rejected if the insurer discovers pre-existing security gaps that weren't disclosed during the policy purchase. Be transparent about your cybersecurity posture to avoid this pitfall.

Overlooked policy exclusions: Certain risks, like nation-state attacks, may not be covered. It's essential to review your policy thoroughly and understand what’s excluded so you don’t face any surprises when filing a claim.

Fraudulent claims: Attempting to exaggerate or fabricate a cyber incident can lead to immediate claim denial—and even legal consequences. Always stay honest and accurate in your claims.

In an age where many Indian businesses have experienced at least one cyberattack, cyber insurance is a necessity. By understanding your risk profile, assessing the scope of coverage, evaluating deductibles, and carefully researching insurers, you can select a cyber insurance policy that offers strong financial protection against the escalating threat of cybercrime.

Don’t wait until it’s too late. A solid cyber insurance policy can be the safety net you need in a world where data is the new currency, and protecting it is more important than ever.

Get expert guidance and compare top cyber insurance policies with Pazcare. Talk to a Pazcare expert today.

Consider the following factors when choosing a cyber insurance policy:

Startups are attractive targets due to valuable data and smaller security teams. Insurance covers breach recovery, legal costs, and reputation management.

In India, cybersecurity insurance premiums range from ₹12,000 to ₹90,000 annually for small businesses, with comprehensive policies averaging ₹2 lakhs for ₹1 crore in coverage. Costs depend on the industry, data sensitivity, and security measures. Strong security protocols can help lower premiums.

Cyber law ensures data protection, legal validity of digital contracts, and defines liability in case of fraud or breaches. It also protects a business’s reputation and continuity